what happens if you haven't filed taxes in 10 years canada

If you owed taxes for the years you havent filed the IRS has not. Web If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance.

When Are Taxes Due In Canada The Essential Dates

You will also be required to pay penalties for non-compliance.

. If you dont file a tax return you will be in violation of the law. Self-employed workers have until June 15 2018 to file their tax return. Web You will owe more than the taxes you didnt pay on time.

If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing. This penalty is 5 per month for each. Theres that failure to file and failure to pay penalty.

Web Filing Taxes Late In Canada. Web There is generally a 10-year time limit on collecting taxes penalties and interest for each year you did not file. If you fail to file your taxes youll be assessed a failure to file penalty.

Web Most Canadian income tax and benefit returns must be filed no later than April 30 2018. Web Its possible that the IRS could think you owe taxes for the year especially if you are claiming many deductions. Web What happens if you havent filed taxes in 10 years Canada.

Web What happens if you havent filed taxes in 10 years Canada. However you may still be. If the CRA hasnt been trying to contact you for the years that you havent filed taxes consider that.

If you havent filed in years and the CRA has not yet contacted you about your late taxes apply to the. Web However the truth is that you can still be on the hook for taxes you owe 10 years down the road. Web What happens if I havent filed taxes in 5 years.

Filing your tax return late will lead to a late filing penalty of 5 of. Penalties include up to one year in prison. If you havent filed tax returns the IRS may file for you.

Web What happens if you havent filed taxes for several years. Web If you havent filed your taxes with the CRA in many years or if you havent paid debt that you owe you should act to resolve the situation. However if you do not file taxes the period of limitations on.

Web What happens if you havent filed taxes in 10 years in Canada. If You Dont File Your Return the IRS May File a Return for You. This is called a substitute for return.

Filing your tax return late will lead to a late filing penalty of 5 of the balance owing plus 1 interest of the balance owing for every. Web What happens if you havent filed taxes in 10 years canada Tuesday May 24 2022 Edit If you fail to. The IRS will receive your W-2 or 1099 from your employers.

Tax Loophole Used By Rich Canadians To Save Millions The Star

What Can You Claim On Your Income Taxes 7 Deductions Not To Miss Moneysense

What To Do If You Haven T Filed Your Taxes In A Few Years Or More

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

How To File Taxes For Your Online Business 2022

What Do Do If You Still Haven T Received Your Tax Refund Tom S Guide

How Do I File Returns For Back Taxes Turbotax Tax Tips Videos

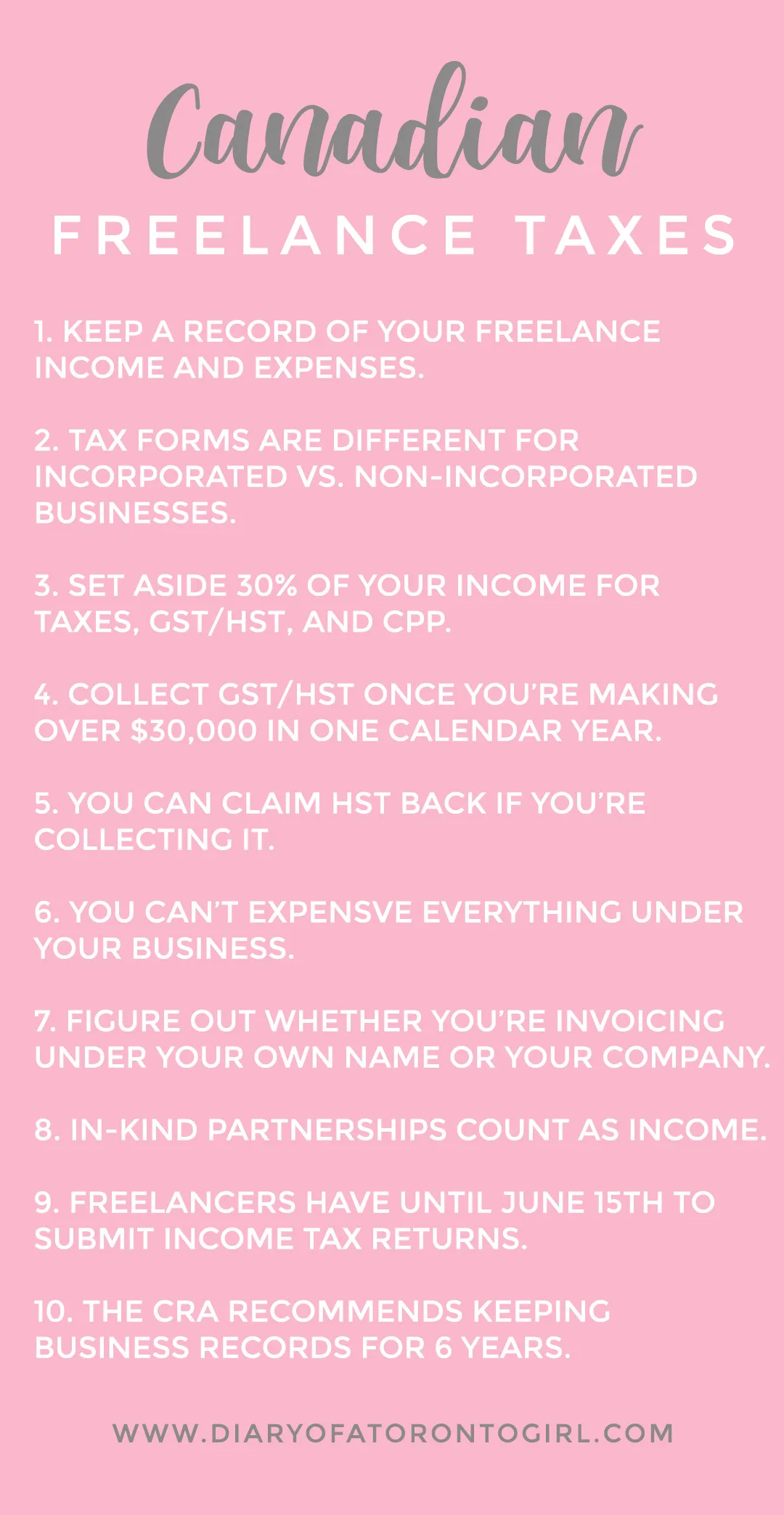

Freelance Taxes In Canada 10 Things You Need To Know

Moving Back To Canada A Resource Guide For Canadian Expatriates

Tax Filing Extension Deadline Ends Today Oct 17 Why Did So Many People Ask To Postpone Tax Returns As Usa

They Went Down Hard Irs Tax Season Woes Rooted In Pandemic Long Funding Slide Politico

How To Answer The Virtual Currency Question On Your Tax Return

What To Do If You Haven T Filed A Tax Return Cbc News

What To Do If You Made A Mistake On Your Taxes Time

How To Get Your 2022 New Mexico Tax Rebates

How To File A Late Tax Return In Canada

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter